per capita tax revenue

We calculate the per capita income as 500000 50 1000 25000 to arrive at 50000000 in total income. Alebiosu 2018 showed that tax revenue has a statistically significant relationship with per capita income in Nigeria.

State Income Tax Collections Per Capita Map Graphing Cartography

Tax collections of 11311 per capita in the District of Columbia surpass those in any state.

. The government collected approximately 14998 in tax revenue per person in 2016 a decrease from the previous year but an increase of 54 compared to 9749 in 1980. This tax is due yearly and is based solely on residency it is NOT dependent upon employment or property ownership. Total tax revenue as share of GDP 10 20 30 40 GDP per capita 1000 10000 100000 2000 5000 20000 50000 China China India India United States United States Indonesia Indonesia Pakistan Pakistan Brazil Brazil Russia Russia Mexico Mexico Democratic Republic of Congo Democratic Republic of Congo Germany Germany Tanzania Tanzania Sudan Sudan.

Castro emphasizes that the increase in revenue per capita converges with data on the greater participation of municipalities in the countrys total direct tax collection when compared to the states and federal governments. US Per Capita Government Revenue. For local governments includes wages salaries and other compensation earned by both residents and nonresidents that are subject to tax collections by the reporting government.

Note this data includes state taxes onlyExcluding local taxes can bias comparisons for some states. 2415 KB August 27 2021. T40 Individual Income Taxes.

Individual income taxes accounted for 38 of government funding in 2016 compared to 37 in 1980. Rankings of State and Local Per Capita General Revenue. Municipalities and school districts were given the right to collect a 1000 per capita tax under ACT 511 and School Districts an additional 500.

The tax percentage for each country listed in the source has been added to the chart. The state of Washington had the highest cannabis tax revenue per capita in 2019 at approximately 6731 US. Per capita taxes like all taxes cost money to collect and per capita taxes are also inequitable.

Tax Revenue Per Capita Income Tax Revenue divided by The Taxable Population Whether youre employed or not you are required to pay the same amount. Return to RevenueBurdens Page. Relation between the tax revenue to GDP ratio and the real GDP.

Users should look at Summary of Tax Burden Measurement Methods article for a. Ex-post Facto research design was adopted. Now the amount may vary from year-to-year but that is up to your local government and jurisdiction.

State Revenues and Expenditures. Total tax revenue as a percentage of GDP indicates the share of a countrys output that is collected. When we divide 50000000 1050 total population the per capita income is.

In Massachusetts cannabis tax revenue per capita was around 1292 US. Taxes on individuals measured by net income and taxes on special types of income eg interest dividends income from intangible property etc. While Olaoye and Ayeni 2019.

Main Features of State Tax Systems. Babatunde and Afintinni 2016 reported. The share of city halls in this collection increased to 77 in 2019 from 62 in 2010 and to 81 in 2020.

2019 State Tax Revenue. US Per Capita Government Revenue. Federal Tax Components and Credits by State.

On average state and local governments collected 1198 per capita in individual income taxes but collections varied widely from state to state a function of both rate structures and income distributions with higher-income states generating significantly more revenue per capita whether they have a high graduated rate system like California or a modest flat-rate. The population constituted the. Tax revenue is defined as the revenues collected from taxes on income and profits social security contributions taxes levied on goods and services payroll taxes taxes on the ownership and transfer of property and other taxes.

58051 KB Download state_local_pcxls. The five states with the highest tax collections per capita are New York 9829 Connecticut 8494 North Dakota 7611 New Jersey 7423 and Hawaii 7332. Total US government estimated revenue for 2022 is 832 trillion including a budgeted 444 trillion federal a guesstimated 234 trillion state and aguesstimated 155 trillion local.

Per capita Property Tax Revenue per capita General Revenue From Own Sources per. Total US government estimated revenue for 2022 is 798 trillion including a budgeted 417 trillion federal a guesstimated 226 trillion state and aguesstimated 155 trillion local. The five states with the lowest tax collections per capita are Tennessee 3286 Alabama 3527.

This study assesses Tax Revenue on Per Capita Income of Nigeria. For example a housewife with no income pays the. This article lists countries alphabetically with total tax revenue as a percentage of gross domestic product GDP for the listed countries.

The composition of total government revenue has changed little over time. Tax revenue as percentage of GDP in the European Union. In fiscal year 2018 with the national average set at 100 the per capita local tax revenue of Tokyo prefecture stood at 1611 index points.

Average Tax Return In Usa By State And Federal Revenue From Income Taxes Per Capita In Each State Infographic Tax Refund Tax Return Income Tax

Map Of Property Taxes On Business Inventory By State American History Timeline Map Rapid City

Map Of Property Taxes On Business Inventory By State American History Timeline Map Rapid City

Reporting Of Per Capita Distributions By Tribal Members Tribal Internal Revenue Service Distribution

Us State Tax Revenue Per Capita Data Interestingdata Beautifuldata Visualdata State Tax U S States Information Visualization

Per Capita Discretionary Spending Vs Share Of Nonpayers 1950 2010 Charts And Graphs Graphing Fiscal

Top 15 Countries By Gross National Income Gni Current Us 1960 2018 Gross National Income National Country

The Evidence Suggests That All The Pathologies Associated With Foreign Aid Appear To Manifest In The Context Of Intra Country Transf Pathology Transfer Context

All The Instagram Dms Between The Girl I Like And Myself For The Past 4 Months Data Interestingdata Beaut Information Visualization Bar Graphs Infographic

The Case For Really High Taxes In 2021 Environmental Problem Zero Sum Game Passion Project

Monday Map Tax Increase From Fiscal Cliff For Median Four Person Family In Each State Fiscal State Tax Tax

Rbse Solutions For Class 12 Economics Chapter 15 National Income And Its Related Aggregates Https Www Rbsesolutions Com Economics Economics Textbook Chapter

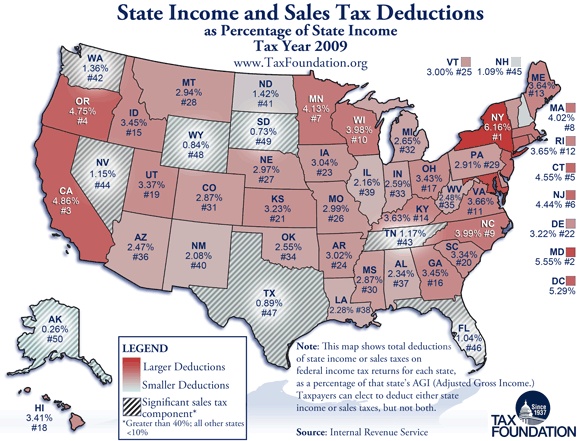

Monday Map State Income And Sales Tax Deductions Data Map Map Map Diagram

Infographic The Countries Spending The Most On Beer Beer Beer Sales Chart

Pin By Hafeez Kai On Infographic Per Capita Income Infographic Challenges

U S States Target Corporate Cash Stashed Overseas Overseas Tax Haven States

Pin By Marutie Pv On Info G Information Visualization Data Visualization Word Cloud