avalara tax code nt

51 - Finding a Tax Code. The tax code should be passed with a 0 line amount.

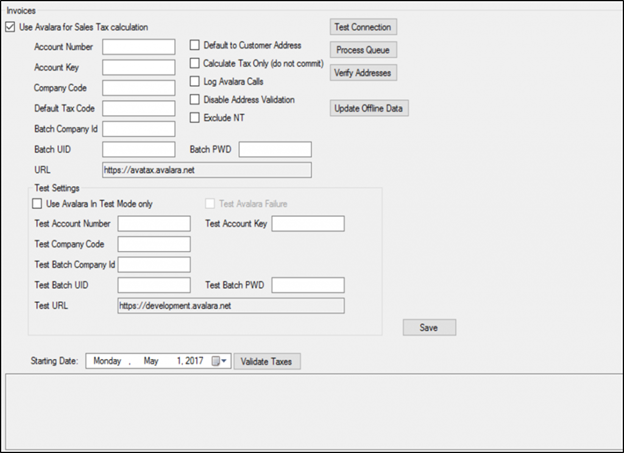

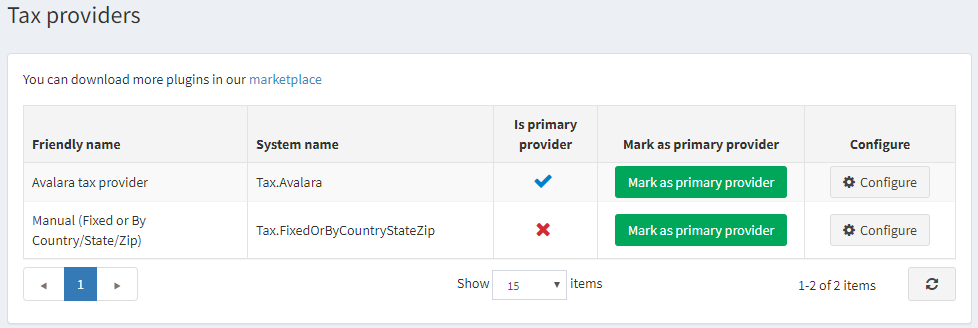

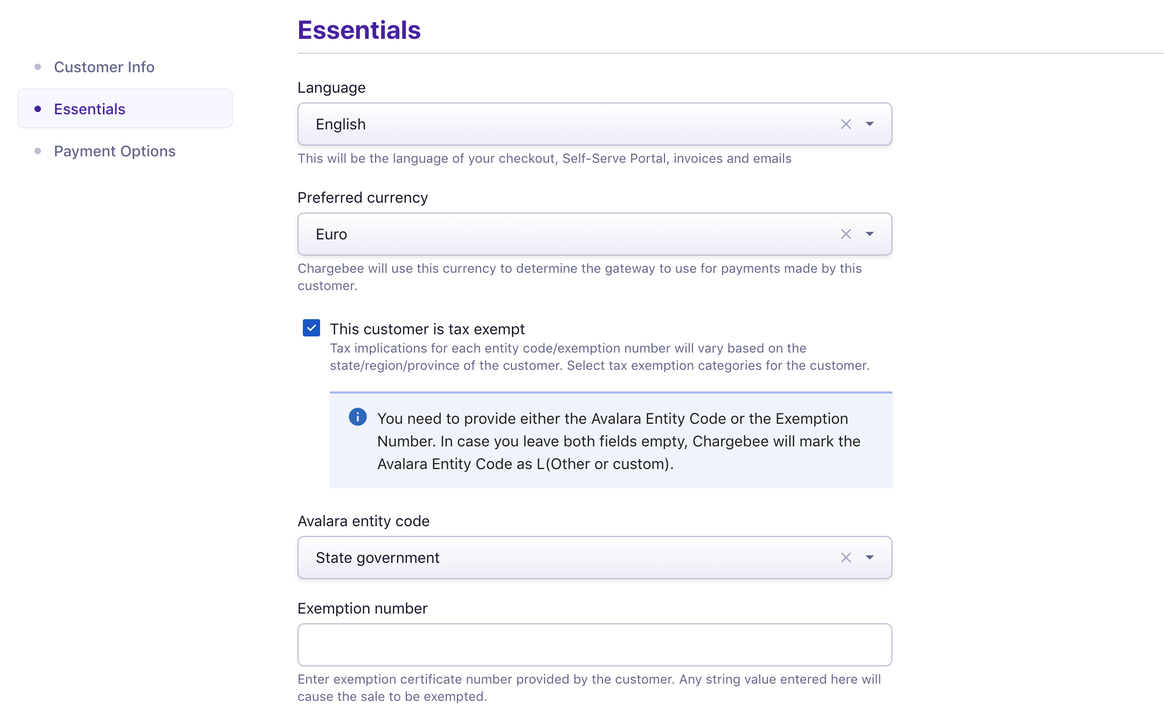

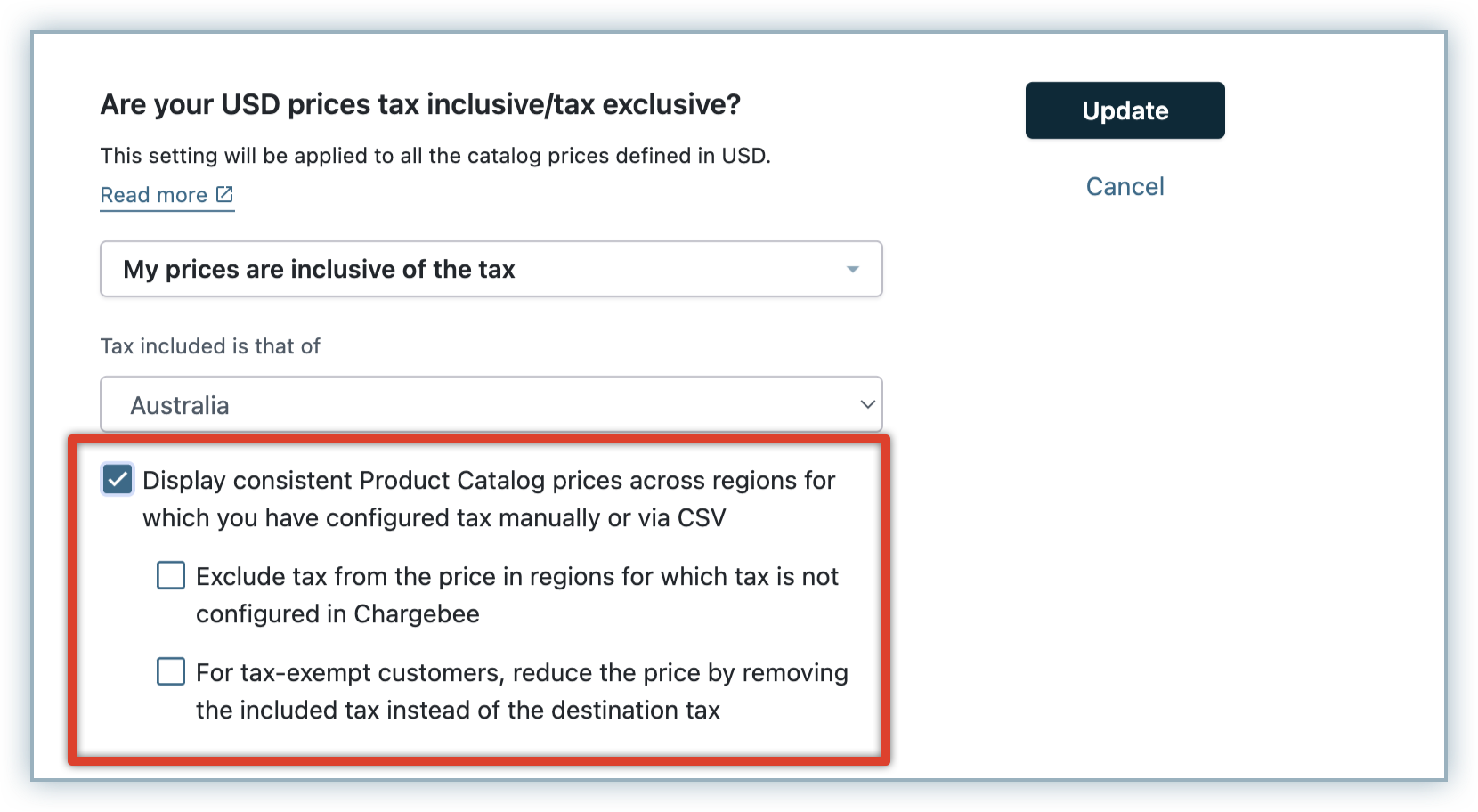

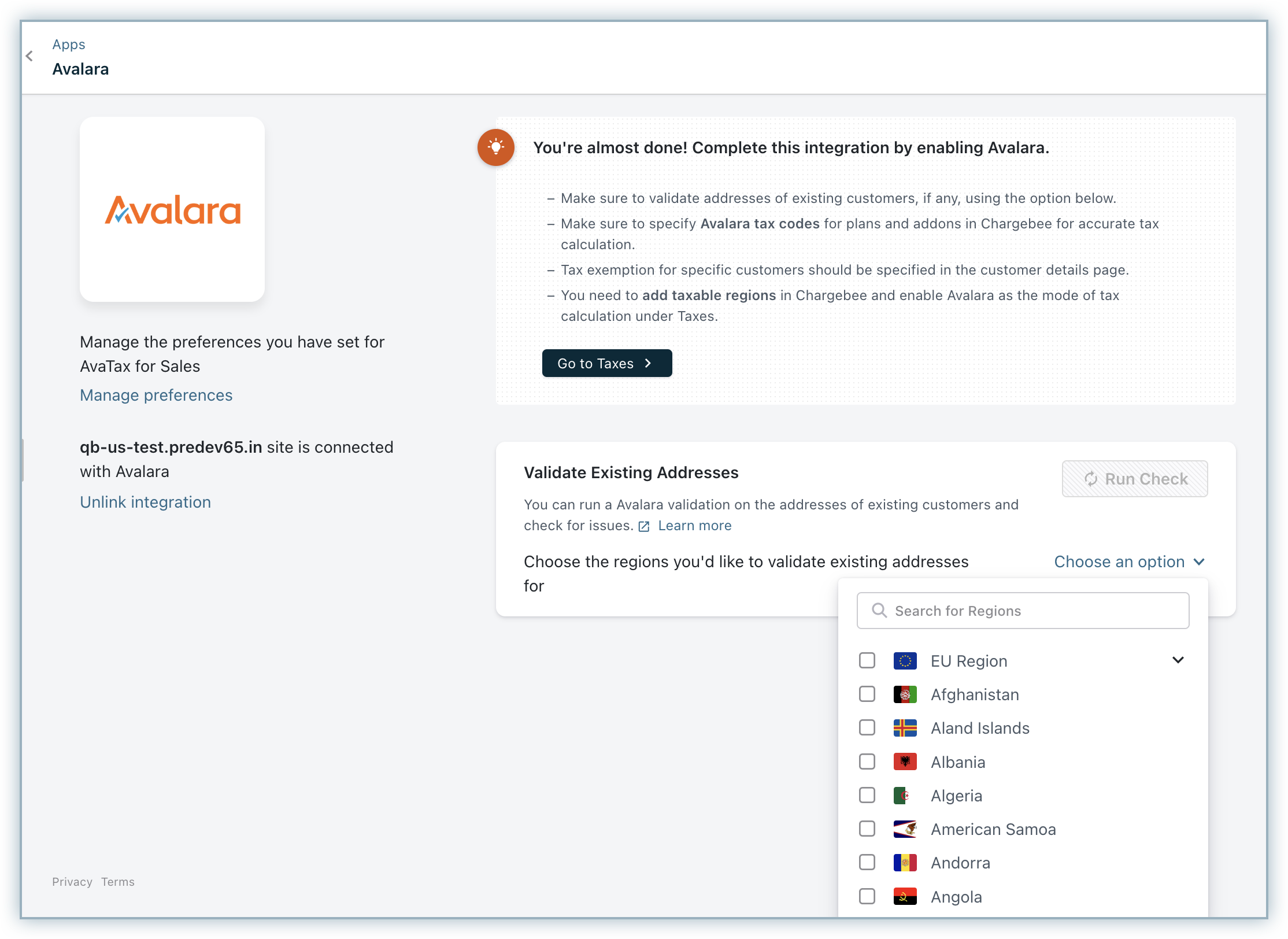

Avatax For Sales Chargebee Docs

So far in the developer guide your code has left the taxCode field empty.

. This tax code is only to be used to trigger colorados 027 retail delivery fee. A tax code is a unique label used to group Items products services or charges together. You can copy and paste a code you find here into the Tax Codes field.

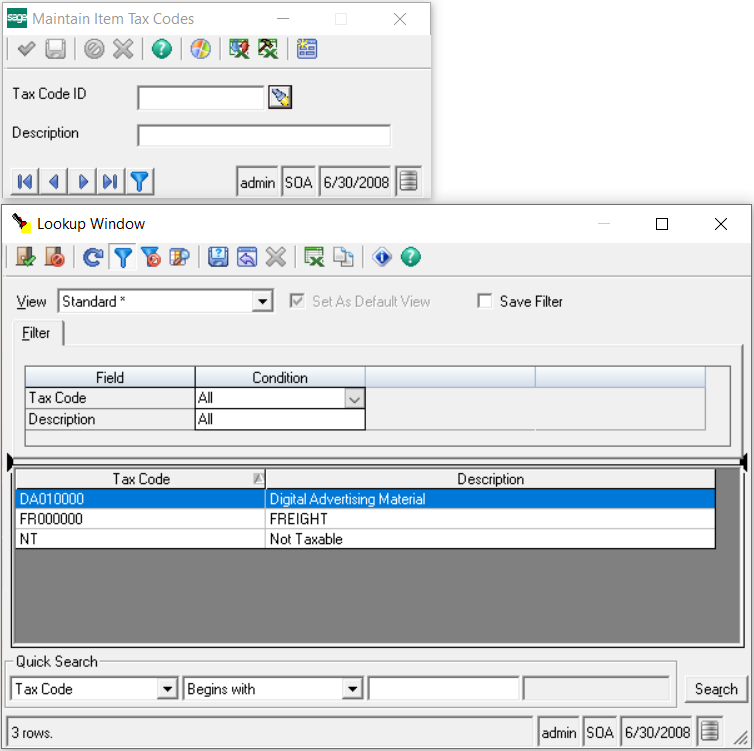

The 2018 United States Supreme Court decision in South Dakota v. You can use this search page to find the Avalara codes that determine the taxability of the goods and services you sell. P0000000 and U0000000 P0000000 and U0000000 are generic codes that are used when you have items.

The estimated 2022 sales tax rate for 33966 is. The 027 fee will automatically be calculated when. In this case AvaTax assumes you are creating transactions that refer to general.

NT is used for items that arent taxable anywhere in the US. Tax codes typically identify categories of like products services or. Has impacted many state nexus laws and sales tax collection.

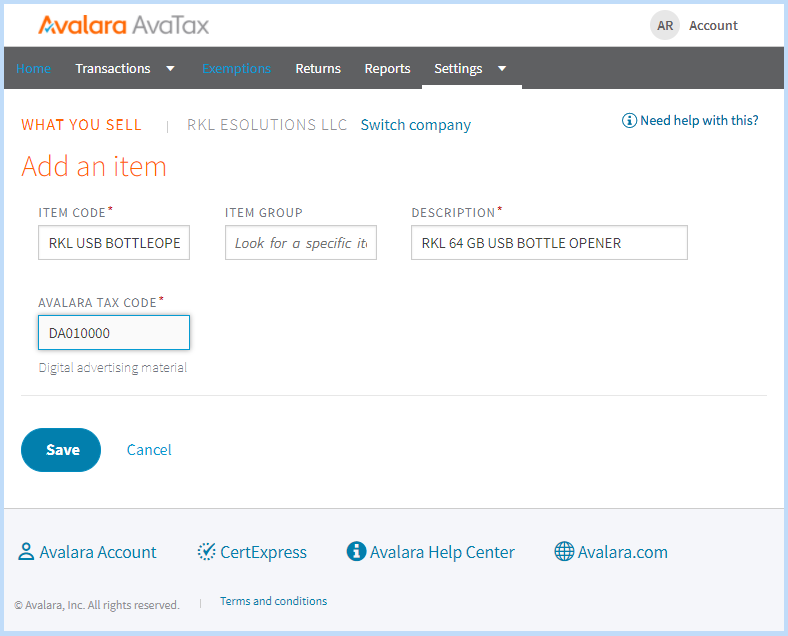

For AvaTax clients without a Checkout Bag service entitlement and nexus setup for Checkout Bag the engine will only return the applicable sales and use tax but not the Checkout Bag tax. To assign an Avalara product tax code to a variant log into your Avalara account click Settings in the upper-right of the admin screen then click Manage items with special tax treatment.

Avatax For Sales Chargebee Docs

Commerce Avatax 5 X Drupal Org

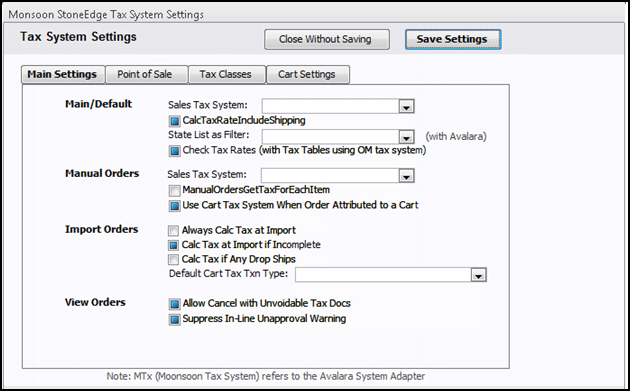

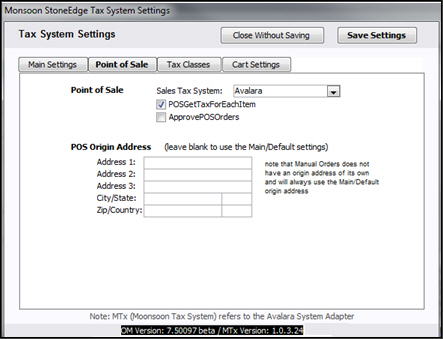

Avatax For Sage 500 Erp Mapping Items To Product Tax Codes

Avalara Nexternal Integrated Accurate Commerce Sales Tax

Software Sales Tax Solutions Avalara

Avalara Tax Code Classification And Avatax Cross Border Solutions Youtube

Avalara Tax Code Classification And Avatax Cross Border Solutions Youtube

Avatax For Sage 500 Erp Mapping Items To Product Tax Codes

![]()

Odoo Ava Tax Module User Guide Ava Tax Calculation Service Bista

Understand Sales Tax Holidays In Avatax Avalara Help Center

Commerce Avatax 5 X Drupal Org